Safer In The Bank

First Savings Bank is well-positioned to protect your deposits and provide you with peace of mind.

While we understand that recent events in the financial industry may have caused some concern and uncertainty, First Savings Bank has a strong capital position and ample reserves to protect against unexpected losses. We maintain a healthy balance sheet and strong liquidity position to ensure that we meet the obligations of our customers. As an FDIC-insured bank, deposits are automatically insured up to at least $250,000 per depositor, per ownership category. And, our team is available to help you assess, understand, and structure your deposit accounts to ensure FDIC coverage.

What is the FDIC and Insurance Coverage

The FDIC (Federal Deposit Insurance Corporation) is an independent agency of the United States government that oversees the banking industry. The FDIC insures trillions of dollars of deposits in U.S. banks and thrifts – deposits in virtually every bank and savings association in the country. Think of FDIC insurance like other types of insurance. Just as your auto insurance covers damages up to a certain dollar amount if your vehicle is in an accident, the FDIC will cover your money up to a certain dollar amount if your bank shuts down.

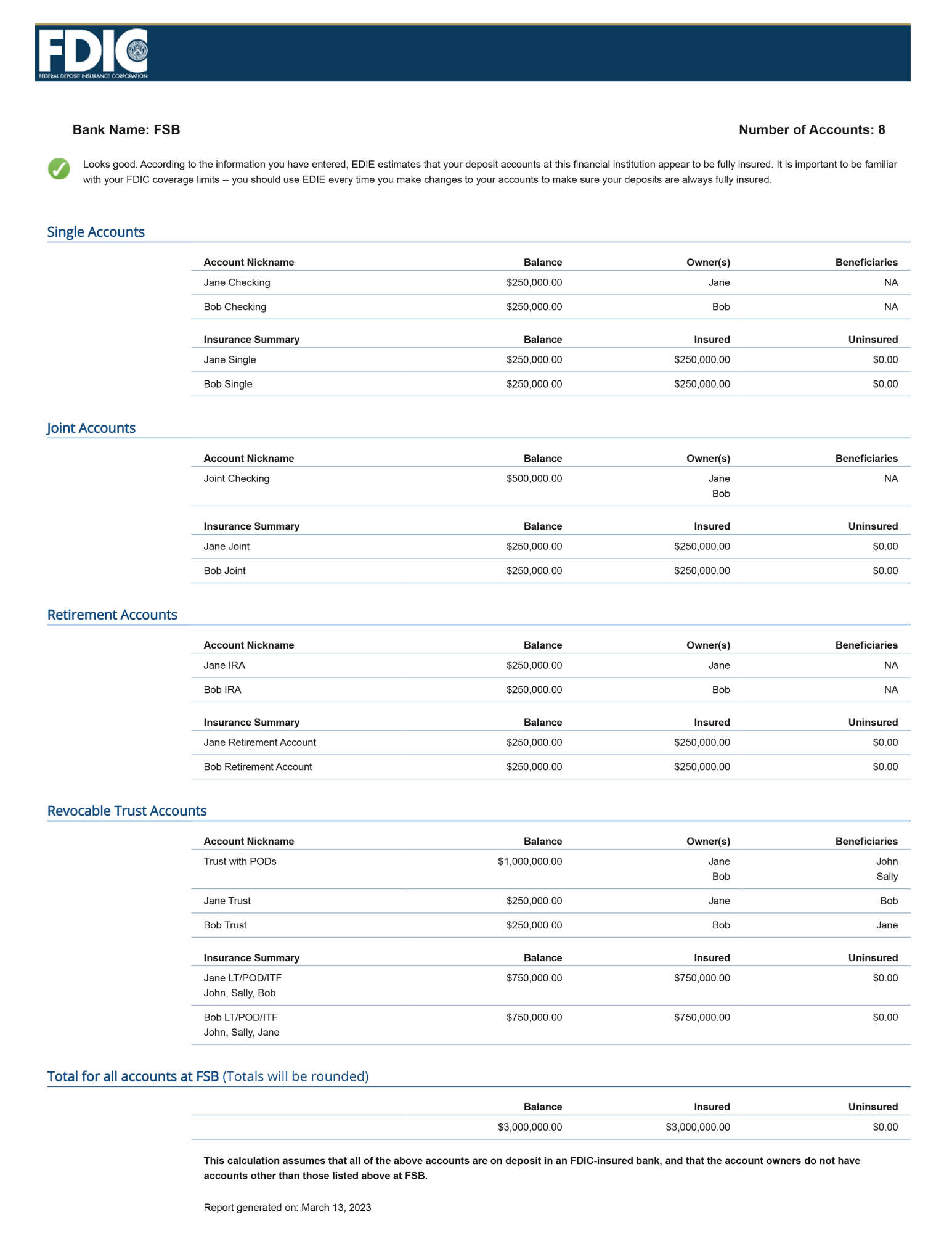

FDIC insurance covers many different types of deposit accounts, including checking accounts, savings accounts, CDs, and more. If you want to boost your coverage, you can open multiple accounts, add beneficiaries to your accounts, or open custodial accounts for your children. Joint and individual accounts are insured separately, so opening both types of accounts can increase your coverage.

Let’s Look at an Example of FDIC Coverage for a Married Couple:

What if I Still Want to Take My Money Out of the Bank?

While fear may impact many financial decisions, be aware that there are just too many risks involved when money is taken out of a bank instead of keeping it in an account. If money is lost, stolen or destroyed it is not insured and it cannot be replaced. Always take a thoughtful and careful approach to any financial decision and speak with a financial advisor or investment professional to help make informed decisions that provide a level of comfort with each investment option.

“The safest place for your money is inside a bank. Banks will continue to ensure that their customers have access to funds either directly or electronically,” the FDIC said.

What Resources are Available to Help Me Learn More

The FDIC website provides a wealth of information on FDIC insurance and bank safety, including FAQs, educational resources, and interactive tools.